Welcome to The Bear Cave! Our last premium articles were “Problems at Two Paper Products Companies” and “More Problems at KinderCare (KLC)” and our next special investigation comes out this Thursday, July 3.

New Activist Reports

Wolfpack Research published on CTO Realty Growth (NYSE: CTO — $570 million), a shopping center REIT. Wolfpack Research called CTO “the B. Riley of REITs” and claimed that “management has deceived investors with a bulls**t AFFO and false and misleading statements about its tenants.” Wolfpack Research alleged the company has a $38 million “cash shortfall in paying dividends since 2021” which has been temporarily fixed through share issuances, with shares outstanding increasing 70% since 2022. Wolfpack also highlighted “a host of problems like plummeting foot-traffic, escalating vacancies, collapsing rents, and ultimately free-falling property values” and alleged the company misrepresented the health of top tenant Ashford Lane and loaned the struggling tenant money while also increasing rent.

Grizzly Research published on Microvast Holdings (NASDAQ: MVST — $1.31 billion), a lithium-ion battery company. Grizzly conducted several site visits to the company’s German and Chinese manufacturing facilities and found lower levels than expected activity, which ultimately led Grizzly to allege that “the company is fabricating a significant part of its business and capabilities.”

In November 2023, J Capital Research also published on the company and alleged that ~57% of revenue “may be fake” because the company’s Chinese factory “shows almost no activity.”

New activist BMF Reports published on INmune Bio (NASDAQ: INMB — $124 million), an Alzheimer’s-focused biotech company. BMF said the company has “no commercial product [and] no credible data” and alleged the company “issued millions in stock to a suspicious consultant entity using what appears to be a fake LinkedIn identity and a virtual shell office in Vancouver” and “has a pattern of using off-book advisors, cross-border shell entities, and non-disclosed conflicts of interest to enrich insiders.”

Sakura Research published on Singapore Technologies Engineering (Singapore: S63 – SGD24.4 billion), a Singapore-based defense and aerospace technology company. Sakura called the company “an overpriced over-leveraged defense play handicapped by a high debt load, high annual capital expenditure spend, negative tangible net asset value and unrecognized goodwill impairment” and said that “reported annual net income has not been able to cover its annual capital expenditures together with its annual dividends paid to shareholders every single year since 2015.”

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of Trex (NYSE: TREX — $5.88 billion) resigned after nearly two years “to accept a position in Minnesota, near her family.”

Mr. Eric Chan, board member of Lanvin Group Holdings (NYSE: LANV — $285 million), resigned from the board just six months “due to personal reasons.” Mr. Chan joined the board after stepping down as CEO in January. The Chinese luxury fashion company has had two CEO departures, a CFO departure, and four board departures since its December 2022 SPAC merger. In an August 2024 comment letter, the SEC raised concerns abouts the company’s “non-IFRS adjustment for ‘marketing and selling expenses’ in the calculation of contribution profit,” its financing arrangements with Meritz Securities, and noted that the company’s officer certifications incorrectly “exclude the language… regarding responsibilities for establishing and maintaining internal control over financial reporting.” The company is audited by Grant Thornton Zhitong and is down ~80% since its SPAC merger.

Chief Customer Officer of Sprinklr (NYSE: CXM — $2.13 billion) departed after nearly one and a half years.

Data for this section is provided by VerityData from VerityPlatform.com

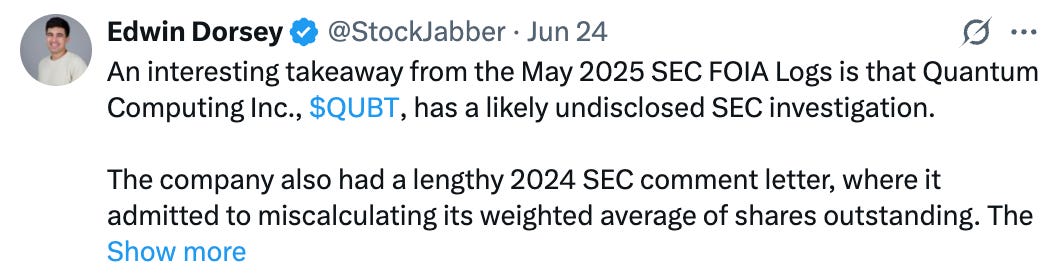

Potential Undisclosed SEC Inquiries

This week, the SEC released its May 2025 FOIA Logs, which include companies where the SEC applies a B7A exemption, indicating a potential undisclosed SEC investigation. Companies with likely undisclosed SEC investigations include:

Zscaler (NASDAQ: ZS — $49.1 billion)

Fortinet (NASDAQ: FTFT — $78.9 billion)

Bank OZK (NASDAQ: OZK — $5.31 billion)

Altice USA (NYSE: ATUS — $996 million)

AstraZeneca (NASDAQ: AZN — $215 billion)

JAKKS Pacific (NASDAQ: JAKK — $229 million)

Hormel Foods (NYSE: HRL — $16.8 billion)

A10 Networks (NYSE: ATEN — $1.38 billion)

Axos Financial (NYSE: AX — $4.33 billion)

AGCO Corporation (NYSE: AGCO — $7.64 billion)

Eli Lilly & Company (NYSE: LLY — $735 billion)

Quantum Computing Inc (NASDAQ: QUBT — $2.68 billion)

International Business Machines (NYSE: IBM — $269 billion)

MACOM Technology Solutions Holdings (NASDAQ: MTSI — $10.6 billion)

Track the SEC’s FOIA Logs, search the entire SEC FOIA database, and get email alerts on your portfolio companies at FOIAsearch.com. View last month’s list here.

News of the Week

“A Fresh Perspective on Long/Short Investing” (David Orr Interview)

Former L/S hedge fund manager Bill Martin interviews current L/S hedge fund manager David Orr. Mr. Martin wrote, in part,

“I find him to be one of the more out-of-the-box, thoughtful and sharp young investment managers that I know, and I have learned a lot by following him. He has also had incredible success while also actively managing a diverse short book. Recently, I purchased shares of ORR for my family trust.”

David talks about shorting BDCs, his desire to fund new L/S PMs, energy policy, and his decision to launch a long/short ETF. You can find a list of all holdings in the Militia Long/Short Equity ETF, including short positions, here. Disclosed shorts include Eagle Point Credit (NYSE: ECC — $910 million), Oxford Lane Capital (NASDAQ: OXLC — $1.88 billion), Runway Growth Finance (NASDAQ: RWAY — $396 million), TriplePoint Venture Growth BDC (NYSE: TPVG — $280 million), BlackRock TCP Capital (NASDAQ: TCPC — $650 million), and Prospect Capital (NASDAQ: PSEC — $1.44 billion). (Sunday’s Idea Brunch also previously interviewed David Orr in October 2022 here.)

“Don’t Fall For This Stock Scam” (Herb Greenberg)

A good summary of the stock promotion scam that led to the ~95% stock collapse this week in Ostin Technology Group (NASDAQ: OST — $38 million).

Tweets of the Week

Until Thursday,

The Bear Cave