🐻The Bear Cave #8🐻

Luckin Coffee and a Questionable Audit Partner, EH, CRTO, GDS, WDFC, ATHX, YEXT & More!

Welcome to The Bear Cave — your weekly source of short-seller news. Feedback and sharing are always appreciated. If you are new, you can join our email list here.

Luckin Coffee Tanks

Luckin Coffee (NASDAQ: LK — $1.36 billion), the Chinese coffee giant once deemed “the Starbucks of China,” fell 80% last week after the company announced hundreds of millions of its reported sales were fraudulent. In a shocking SEC filing, Luckin announced,

“Beginning in the second quarter of 2019, Mr. Jian Liu, the chief operating officer and a director of the Company, and several employees reporting to him, had engaged in certain misconduct, including fabricating certain transactions… Investors should no longer rely upon the Company’s previous financial statements and earning releases for the nine months ended September 30, 2019.”

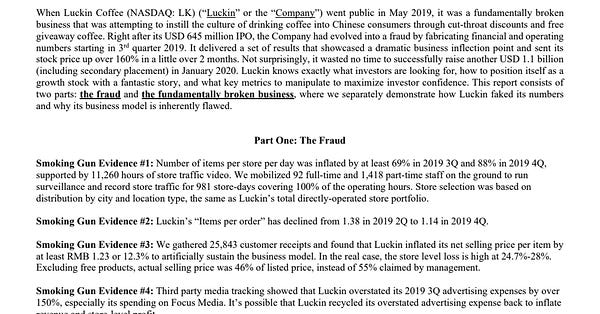

In January, Muddy Waters Research publicly announced it was short Luckin and shared an anonymously authored report that detailed allegations of inflated revenue. In February, JCap Research published a cautionary note on Luckin.

According to PCAOB records, the Ernst & Young Engagement Partner that audited Luckin’s 2018 financials is Lei Yang. Mr. Yang appears as the engagement partner for only two other public companies. One of the companies, ChinaCache International Holdings, was delisted from the NASDAQ and fell over 95% after the CEO resigned amid bribery allegations. The other company, EHang Holdings (NASDAQ: EH — $640 million) is China’s “leading autonomous aerial vehicle technology platform.” EHang IPO’d in December 2019 and has yet to file audited financials as a public company.

New Activist Shorts

Gotham City Research announced it is long ad-tech firm Criteo (NASDAQ: CRTO — $526 million). The announcement is notable because, in September 2017, Gotham City Research went short Criteo and published a report titled, “Criteo: The True Fraudster in the Adtech Industry?” Criteo shares are down 80% since Gotham’s 2017 short report and could rise 400% if Gotham’s new mid-range price target is reached.

JCap Research published an update on GDS Holdings (NASDAQ: GDS — $7.79 billion) and alleged, “GDS board members control at least two undisclosed service companies that contract with GDS.”

Spruce Point Capital issued a “strong sell” warning on WD-40 Company (NASDAQ: WDFC — $2.34 billion).

Alpha Exposure “found significant issues” with Athersys’s (NASDAQ: ATHX — $472 million) recently announced coronavirus treatment.

Yext (NYSE: YEXT — $1.02 billion) is down 34% since The Bear Cave highlighted the company as a “coronavirus stock to watch.” You can read more about Yext here.

Tweets of the Week

This Email is Not Investment Advice and Represents the Author’s Opinions

New to The Bear Cave? Join Our Email List!

Contact: edorsey@stanford.edu / (718) 873-2362 / @StockJabber