🐻The Root Insurance Scam (ROOT) Bear Cave #58🐻

The Root Insurance Scam, New Activist Reports, Tweets of the Week, and More!

Welcome to The Bear Cave — your weekly source of short-seller news. If you are new, you can join our email list here.

The Root Insurance Scam

Car insurance companies are some of the biggest beneficiaries of the coronavirus pandemic. Less driving has led to fewer accidents, which has led to more profits. Under pressure from regulators, many insurance companies are rebating some profits to customers and lowering insurance rates.

One upstart insurance company is bucking the trend. Root Insurance (NASDAQ: ROOT — $3.02 billion), founded six years ago and publicly traded for six months, is aggressively hiking insurance premiums on customers.

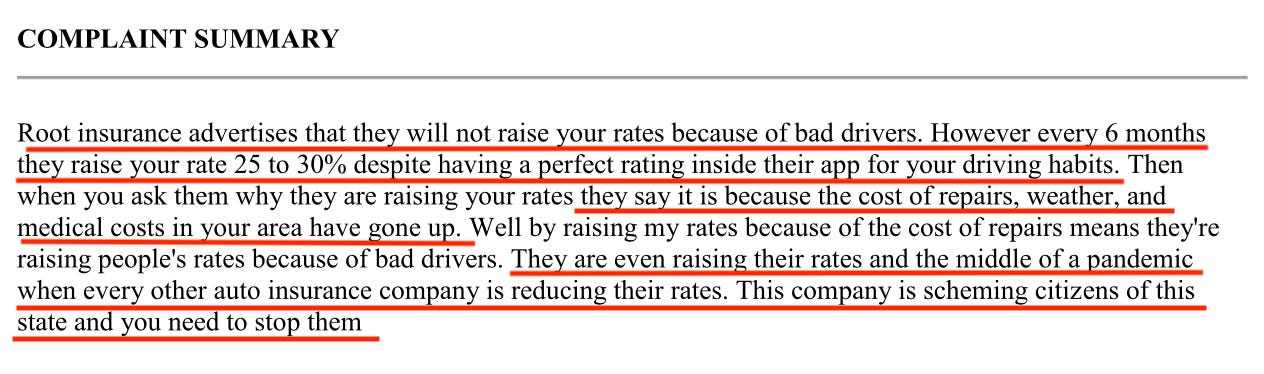

A Root Insurance receipt obtained by The Bear Cave shows a nearly 30% rate increase during the pandemic months:

FOIA requests filed with the Texas Attorney General revealed a similar pattern of pandemic price increases among perfect drivers.

“…the rate increased 21% even though I have made no claims, have no speeding tickets, and the amount driven … has plummeted due to the pandemic.”

“…they raise your rate 25 to 30% despite having a perfect rating inside their app … they are even raising their rates [in] the middle of a pandemic when every other auto insurance company is reducing their rates.”

On its Q3 earnings call Root’s CFO highlighted “quite significant” underwriting improvement and claimed “we took base rates down” in Texas, which is Root’s largest market.

In response to consumer complaints across the country, Root claims “the increasing cost of car repair and medical care, and damaging weather events” as potential causes of rate hikes. The leads me to believe Root may be lowering base rates (to appease regulators) while increasing total customer rates by using the weather/repair costs as an excuse.

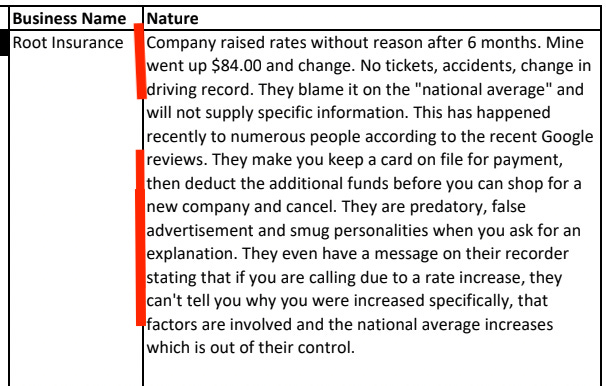

Complaints from other states indicate problems at Root Insurance as well, particularly around policy cancellations. One consumer in Missouri told her Attorney General that Root “[makes] you keep a card on file and [deducts] additional funds before you can cancel.”

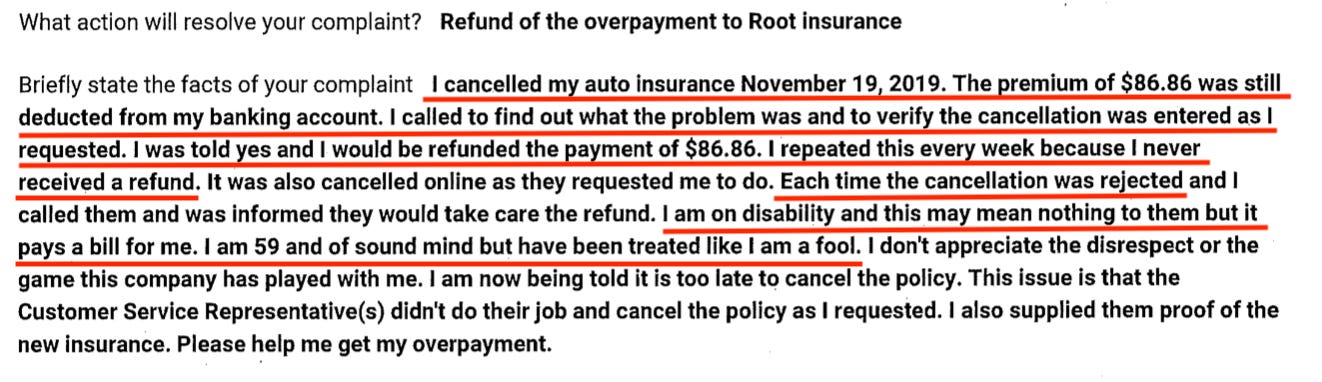

Below is a complaint to the Kentucky Attorney General, where a disabled woman was not given a refund despite multiple attempts to cancel her policy.

In response, Root’s Deputy General Counsel told the Kentucky Attorney General, “the Company recognizes that errors were made by the customer service department” and “Root is always striving to improve the customer experience.”

In its most recent 10-K, Root disclosed a “market conduct examination” by the Virginia Bureau of Insurance and a financial examination by the Ohio Department of Insurance. The National Association of Insurance Commissioners publishes a Complaint Index Report every year. Root scored a 3.90 in 2020, meaning that it receives 3.9 times as many complaints as expected for a company of its size.

Root Insurance might not be around for long.

Root Insurance tells investors it can price insurance better by using its data-collecting app, which distinguishes good drivers from bad ones by tracking driving speed, braking, travel times, phone usage, and other factors. This technology will soon be obsolete as connected car companies like Otonomo and WeJo begin collecting data directly from cars and sell the driving data to traditional insurance companies.

If new technology does not eliminate Root, losses and churn might. Roughly two out of three of Root’s customers leave every year and the company lost $363 million last year.

Follow me on Twitter @StockJabber for updates. Read The Bear Cave’s previous coverage on Root Insurance here.

New Activist Reports

An anonymous Twitter account published on Skillz (NYSE: SKLZ — $9.52 billion), a mobile gaming platform that went public through a SPAC last year. The report said,

“[Skillz] is simply another skill-based gambling startup (as evidenced primarily by how it’s regulated) that turns single-player mobile games into cash-based betting competitions for users. These exact, literally identical, business models have existed in the past and have largely gone defunct or failed to scale over time.”

Last week, Wolfpack research published on Skillz and alleged that the company “has a history of announcing partnerships which have historically amounted to very little.”

Sharesleuth published on Solarwindow Technologies (OTC: WNDW — $742 million), a solar energy product company that is up 1,000% over the last twelve months. Sharesleuth called Solarwind “the latest iteration of a company that in 23 years of existence has never made a product, never booked an order, and never generated a single dollar of revenue.”

John Hempton published on Credit Suisse (NYSE: CS — $32.0 billion), the Swiss asset manager with ties to the failed Greensill bank. Hempton wrote, “the Greensill problem must be big. Really big. Like huge.”

Citron Research tweeted positively about Lizhi (NASDAQ: LIZI — $523 million), a Chinese podcast, social network and dating company.

*Tips Wanted*

The Bear Cave has some exciting investigations planned for 2021. If you know of any companies misleading customers or shareholders, we are looking for new ideas too. Please hit reply or email edwin@585research.com with any companies that deserve additional scrutiny. The Bear Cave primarily focuses on U.S. companies with market capitalizations between $1 billion and $10 billion.

What to Read

“Potential at Otonomo (SAII)” (The Bear Cave)

“Software Acquisition Group II (NASDAQ: SAII) is in the process of taking Otonomo public in a SPAC deal that will value the company around $1.4 billion. Founded in 2015, Israel-based Otonomo is a platform to manage and sell car data – a new and rapidly growing field. The company has negligible revenue, an unproven industry, great management, and savvy backers. It is my largest personal position.”

“Tesla’s ‘Technoking’ Musk Joins Long Line of Odd Job Titles” (WSJ)

“Other fanciful corporate monikers include chief pillow officer, chief monster maker and chief troublemaker; ‘Master of Coin’…”

“Apollo SPAC and Vista Halt $15 Billion Merger Talks” (Bloomberg)

“Vista Equity Partners’ negotiations to merge three of its companies with acquisition firm Apollo Strategic Growth Capital in a $15 billion transaction have been halted…”

Tweets of the Week

Until next week,

The Bear Cave