The Bear Cave #150 + Year in Review

New Activist Reports, Recent Resignations, Year in Review, and Tweets of the Week

Welcome to The Bear Cave! Our last premium articles were “Problems at Silvergate Capital (SI)” published on December 1 and “Problems at Six Flags Entertainment (SIX)” published on December 15. The next premium investigation comes out this Thursday, January 5.

New Activist Reports

Marcus Aurelius Research published a new Twitter thread on Silvergate Capital (NYSE: SI — $550 million), a bank holding company that has processed over $1 trillion in transactions for the crypto industry. Marcus Aurelius highlighted that Silvergate processes payments for Huobi Global, “a lax-KYC offshore exchange where criminals, including North Korea's Lazarus, have laundered Billions.” Marcus Aurelius showed that Huobi Global approved spurious accounts for “a bearded Taylor Swift and Borat,” noted that Thailand revoked Huobi’s license for compliance deficiencies, and published screenshots showing that Huobi instructed customers to use Silvergate to deposit money into Huobi’s accounts based in Gibraltar. The exchange is owned by Justin Sun, who is reportedly under FBI investigation and was previously accused of money laundering in China.

Two weeks ago, Marcus Aurelius Research also highlighted Silvergate’s payment processing for Bitso, a Mexican crypto operator that has been tied to blackmail, sex trafficking, and kidnapping payments.

Valiant Varriors published on SBI Holdings Inc (Tokyo: 8473 – JPY685 billion), a Japanese financial services conglomerate. Valiant Varriors wrote, in part,

“Meet SBI Holdings, the smaller, more nimble, ultra-aggressive, over-levered machine that is run by a stubborn dictator like boss Yoshitaka Kitao. The company, previously owned by Softbank Holdings, is a broken shell of a company on so many levels.”

Valiant Varriors said that the company’s exposure to crypto “is a black hole and may very well bankrupt the company” and claimed SBI Holdings may need to issue more stock to shore up its balance sheet.

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of ImmunoGen (NASDAQ: IMGN — $1.09 billion) departed “on leave under the Family and Medical Leave Act and will not continue employment with ImmunoGen at the conclusion of her leave” after two and a half years with the company. In November, the company’s Chief Commercial Officer departed after one year “for personal reasons.”

CEO of Minerva Surgical Inc (NASDAQ: UTRS — $6.5 million) “retired” after twelve years, departed the board, and entered into a consulting agreement “in exchange for the issuance of an option award for 0.5% of the Company's fully diluted capitalization.” The company is down ~98% since its October 2021 IPO.

One of the company’s board members, Dr. Ali Behbahani, a partner at venture capital firm New Enterprise Associates, also serves on eight other public company boards: Oyster Point Pharma (NASDAQ: OYST — $300 million), Monte Rosa Therapeutics (NASDAQ: GLUE — $368 million), Nkarta Inc (NASDAQ: NKTX — $292 million), Black Diamond Therapeutics (NASDAQ: BDTX -- $65 million), CRISPR Therapeutics (NASDAQ: CRSP — $3.18 billion), Arcellx Inc (NASDAQ: ACLX — $1.36 billion), Adaptimmune Therapeutics (NASDAQ: ADAP — $239 million), and CVRx Inc (NASDAQ: CVRX — $378 million).

CEO of Enovix Corp (NASDAQ: ENVX — $1.95 billion) “retired” after sixteen years and is also leaving the board.

Chief Human Resources Officer of Gibraltar Industries Inc (NASDAQ: ROCK — $1.42 billion) resigned after almost two years “to pursue another opportunity.” In December, the company’s Chief Operating Officer “mutually agreed” to depart after about four years, and the company’s prior Chief Human Resources Officer resigned in February 2021 after almost five years.

National Production Manager of Guild Holdings (NYSE: GHLD — $616 million) “stepped down” after two and a half years. The company is down ~35% since its October 2020 IPO.

Mr. Lun Feng resigned from the board of NetEase Inc (NASDAQ: NTES — $47.7 billion) “for personal reasons” after almost eighteen years. NetEase’s statement also added, “the Company’s board considers that there are no other matters that need to be brought to the attention of shareholders of the Company.”

Data for this section is provided by VerityData from VerityPlatform.com

2022 Year in Review

In 2022, The Bear Cave was opened over 1,000,000 times, grew to over 35,000 free readers, passed 1,000 paid subscribers, and published 20 company-specific investigations. Those investigations are ordered chronologically below with the performance since The Bear Cave publication date:

“Problems at Embark Technology (EMBK)” which fell ~98% since The Bear Cave’s January 6 investigation

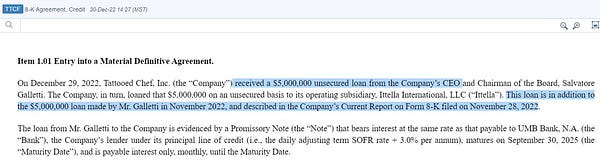

“Problems at Tattooed Chef (TTCF)” which fell ~91%

“Problems at Roblox (RBLX)” which fell ~57%

“Problems at Vail Resorts (MTN)” which fell ~10%

“Problems at Freedom Holding Corp (FRHC)” which fell ~2%

“Problems at eXp World Holdings Inc (EXPI)” which fell ~40%

“Problems at Zeta Global Holdings (ZETA)” which fell ~21%

“Problems at ZoomInfo Technologies (ZI)” which fell ~27%

“Problems at RCI Hospitality Holdings (RICK)” which went up roughly 73%

“Problems at Perion Network (PERI)” which went up roughly 36%

“Problems at Toronto-Dominion Bank (TD)” which went up roughly 1%

“Problems at Olaplex Holdings (OLPX)” which fell ~69%

“Problems at Amalgamated Bank (AMAL)” which fell ~4%

“Problems at Ammo Inc (POWW)” which fell ~55%

“Problems at Coinbase (COIN)” which fell ~55%

“More Problems at Medical Properties Trust (MPW)” which fell ~2%

“Problems at Rumble (RUM)” which fell ~27%

“Problems at Intuit (INTU)” which went up roughly 1%

“Problems at Silvergate Capital (SI)” which fell ~37%

“Problems at Six Flags Entertainment (SIX)” which went up roughly 6%

The Bear Cave also published three broader investigations covering multiple companies: Problems at Corporate Charities, The Five Worst SPAC Deals Still Above $5, and The Great Crypto Collapse.

Our biggest failure this year was our article on RCI Hospitality (NASDAQ: RICK), which has nearly doubled since our criticism. Ouch! In hindsight, we greatly underestimated the management team and the uniqueness of its business, and focused on historical issues not material to the company’s future.

The Bear Cave’s most-read article of 2022 was on safety issues at Roblox (NYSE: RBLX), a children’s videogame platform linked to numerous cases of child abuse and child predators. The investigation went viral on Twitter and The Bear Cave later learned the company prepared an internal presentation on improving safety that cited our reporting. Our goal for 2023 is to elevate this type of impact and continue highlighting the most egregious companies misleading investors and harming customers.

The Bear Cave earns 100% of its income from paid reader subscriptions and does not bet against any company we write about. If you enjoy this newsletter and get value from it, the best way to help is to encourage others to subscribe and hit reply with any tips or feedback.

Your support means the world and we are looking forward to a great 2023!

What to Read

“Caroline Ellison Apologizes for Misconduct in FTX Collapse” (WSJ)

“Ms. Ellison also said she and Mr. Bankman-Fried worked with others to conceal the arrangement from lenders, including by hiding on quarterly balance sheets the extent of Alameda’s borrowing and the billions of dollars in loans that the firm had made to FTX executives and associates. Mr. Bankman-Fried was among the executives who received loans from Alameda, she said.”

“This little-known firm with a weird website was central to the misappropriation of FTX customers' money, regulators say” (NBC News)

“North Dimension was where FTX customers were told to wire money if they wanted to trade on its exchange, according to a complaint filed Wednesday by the Securities and Exchange Commission. But North Dimension Inc. also appears to have been a fake online electronics retailer, an NBC News investigation found. Its website, now disabled, is archived on the internet… FTX customers sending money to North Dimension likely wired it through Silvergate Bank, the San Diego institution that is one of the largest providing financial services to the crypto industry…”

“Letter to Regulators re Banking System Exposure to Crypto” (Senator Elizabeth Warren)

“Dear Chair Powell: We write to express concern regarding recent revelations of ties between the banking industry and cryptocurrency firms and to inquire about how your agency assesses the risks to banks and the banking system associated with those relationships…”

“How Southwest Airlines Melted Down” (WSJ)

“In the wake of the mess, Transportation Secretary Pete Buttigieg and federal lawmakers have stepped up calls for more stringent consumer protection measures. Southwest’s shares have fallen 11% this week, outstripping declines for other airlines…”

Tweets of the Week

Until Thursday,

The Bear Cave