Welcome to The Bear Cave! Our last premium articles were “Problems at Progress Software (PRGS)” and “Problems at Axos Financial (AX)” and our next premium investigation comes out Thursday, December 7.

New Activist Reports

Hindenburg Research published on Golden Heaven Group Holdings (NASDAQ: GDHG — $1.06 billion), a Chinese amusement park operator. Hindenburg alleged that the company’s CEO “has a history of undisclosed fraud allegations” and said the company’s parks “appear to be dystopian hellscapes.” Hindenburg hired an investigator who visited the company’s supposedly popular parks and found them mostly empty, non-functional, or filled with trash:

Hindenburg also highlighted that the company has risen ~5x since its April 2023 NASDAQ IPO “despite little news to justify such a move.” Hindenburg concluded,

“We have major doubts about GDHG’s reported financials given the difference between its reported park activity and observable reality, and given the undisclosed fraud allegations & issues facing its Chairwoman & CEO.”

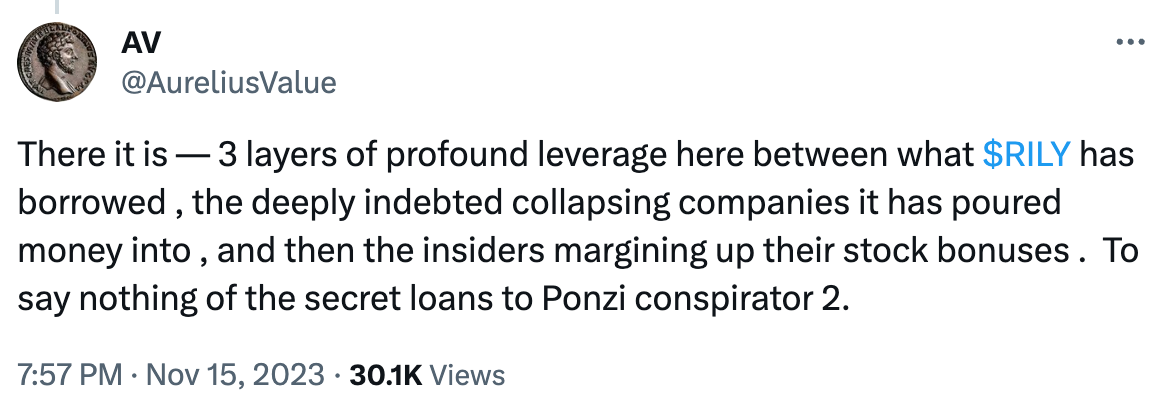

The Friendly Bear published a follow-up report on B. Riley Financial (NASDAQ: RILY — $669 million), an investment bank and financial services company. The Friendly Bear “surfaced several loans between B. Riley and Brian Kahn,” some of which were not disclosed by B. Riley. Recently, Mr. Kahn’s private equity firm, Vintage Capital, was linked to an alleged Ponzi scheme, Prophecy Asset Management, in a complaint filed by the SEC earlier this month. Mr. Kahn has not been accused of or charged with any crime. The Friendly Bear concluded,

“Given the tight relationship between B. Riley and Kahn, and the fact that Kahn was consistently borrowing from B. Riley and selling assets to B. Riley, there is no excuse for how B. Riley ‘missed’ the allegations of wrongdoing involving Kahn – it should have caught the allegations in its loan and manager due diligence as related civil litigation was public dating back to 2021.”

In July, The Friendly Bear criticized B. Riley’s dealings with another closely related public company, Applied Digital (APLD), and wrote that “both companies could face substantial litigation in the coming months due to severe disclosure and governance problems.”

Bleecker Street Research published a follow-up report on PureCycle Technologies (NASDAQ: PCT — $723 million), an emerging plastic recycling company. Bleecker Street called the company’s recent earnings report “a disaster” and highlighted that the company was “shutting down [its] facility to make a multi-million-dollar design change.” Bleecker Street also raised concerns about the company’s various debt covenants and claimed that “PureCycle is at risk of imminent default, and that the value of assets attributable to common equity holders in a default scenario is effectively zero.”

Two weeks ago, Bleecker Street published on PureCycle and “commissioned a drone survey of [PureCycle’s] facility” and based on the drone’s thermal imaging determined that the plant was operating at temperatures not hot enough to melt and recycle plastic.

Iceberg Research published a follow-up report on NuScale Power (NYSE: SMR — $578 million), a small-scale nuclear power company. Iceberg Research highlighted that the company recently lost its key business contract with Utah Associated Municipal Power Systems and is “now staring at the likelihood of bankruptcy” and added that “the company’s only way to stay alive, albeit for a short time, is to massively dilute its shareholders.”

Last month, Iceberg Research published on NuScale’s ties to “a power company whose managing director has previously been charged by the SEC for securities fraud.”

Viceroy Research published on Arbor Realty Trust (NYSE: ABR — $2.36 billion), a mortgage REIT focused on bridge financing. Viceroy claimed that Arbor’s “high-risk multifamily residential bridge loans… are going bad fast” and said that its “entire loan book is distressed and underlying collateral is vastly overstated.” Viceroy added that Arbor’s loans would be unable to be refinanced and concluded that Arbor's equity is worth zero.

In March, NINGI Research also published on Arbor and claimed Arbor was understating credit loss allowances and burdened by “a toxic and worthless portfolio of mobile homes.”

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of Nikola (NASDAQ: NKLA — $1.06 billion) resigned after eight months “to pursue other opportunities.” In August, the company’s CEO departed after nine months and the company’s President of Energy resigned after one year. In addition, four board members have departed this year.

CFO of SmartRent (NYSE: SMRT — $595 million) resigned after one and a half years “to pursue new opportunities” and a board member resigned after three years as well. In September, Bleecker Street Research called the company “a mess with a broken culture” and in February Guasty Winds Musing, an anonymous Substack, showed that “the company’s largest customers appear to be LPs in one of the company’s largest VC shareholders.” The company is down ~70% since its August 2021 SPAC merger.

CFO of Perimeter Solutions (NYSE: PRM — $628 million) resigned “pursuant to a mutual agreement” after one and a half years. The company’s prior CFO also resigned “pursuant to a mutual agreement” after three years and in April 2022 Kevin M. Stein, the CEO of TransDigm, “decided not to continue as a director” of Perimeter Solutions after only five months. Perimeter went public through a “reverse takeover” of a London-based acquisition vehicle in November 2021 and has since fallen ~70%.

CEO of The Beauty Health Co (NASDAQ: SKIN — $300 million) “separated” after almost two years and also departed the board. In February, The Bear Cave published on the company and highlighted “lackluster leadership, high executive turnover, internal accounting issues, and a dubious customer base.” The company is now down ~80% since its May 2021 SPAC merger.

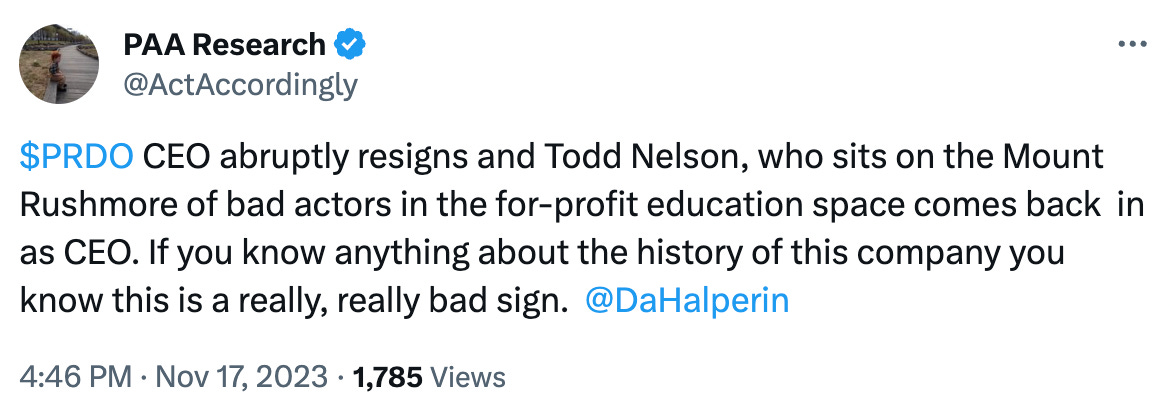

CEO of Perdoceo Education (NASDAQ: PRDO — $1.19 billion) resigned “effective immediately” after almost two years and also departed the board as well.

CFO of DigitalBridge Group (NYSE: DBRG — $2.73 billion) resigned after about three and a half years. In September, the company’s Chief Accounting Officer also resigned after nearly three years “to pursue other opportunities.”

CEO of ProKidney Corp (NASDAQ: PROK — $285 million) was “terminated without cause” after five years. The company is down ~90% since its July 2022 SPAC merger.

CEO and CFO of ChargePoint Holdings (NYSE: CHPT — $727 million) resigned “at the request of the board” after thirteen and six years, respectively. In September, Sunshine Research said the company faced competition from the Tesla supercharging network and the company is down ~80% since its February 2021 SPAC merger.

Quarterback Drew C. Brees, board member of Business First Bancshares (NASDAQ: BFST — $533 million), resigned after two and a half years “to devote his time to various [other] business ventures.”

Data for this section is provided by VerityData from VerityPlatform.com

What to Read

“Jim Chanos, Short Seller Who Took on Enron and Tesla, to Close Hedge Funds” (WSJ)

“More recently, Chanos has struggled to turn his pessimistic positions into profits while markets generally moved higher. His firm, Chanos & Co., manages less than $200 million today, down from $6 billion in 2008, and its funds are down 4% so far this year, while the S&P 500 is up 19%, including dividends… ‘The marketplace for what I do has changed,’ Chanos, 65, told The Wall Street Journal.”

“Strip Clubs, Lewd Photos and a Boozy Hotel: The Toxic Atmosphere at Bank Regulator FDIC” (WSJ)

“A toxic work environment at the FDIC, one of the nation’s top banking regulators, has for years caused employees to flee from an agency they say enabled and failed to punish bad behavior, according to a Wall Street Journal investigation based on interviews with FDIC employees as well as legal filings, union grievances, Equal Employment Opportunity complaints, emails, text messages and other internal documents.”

“Carson Block, Nate Anderson Become SEC Tipsters for Cash Payouts” (Bloomberg)

“Alongside their public reports, short sellers are quietly sharing their research about sketchy accounting and other misdeeds with the US Securities and Exchange Commission’s whistleblower office in hopes of making some extra money. The practice is widespread, with big-name short sellers Nate Anderson, Kyle Bass and Carson Block among the tipsters. If the SEC investigates and levies a fine, a short seller can collect up to 30% of the proceeds.”

Tweets of the Week

Until next week,

The Bear Cave