The Bear Cave #241

New Activist Reports, Recent Resignations, Nine Month Review, and Tweets of the Week

Welcome to The Bear Cave! Our last premium articles were “Problems at Five9 (FIVN)” and “Problems at Verint Systems (VRNT)” and our next special investigation comes out this Thursday, October 3.

New Activist Reports

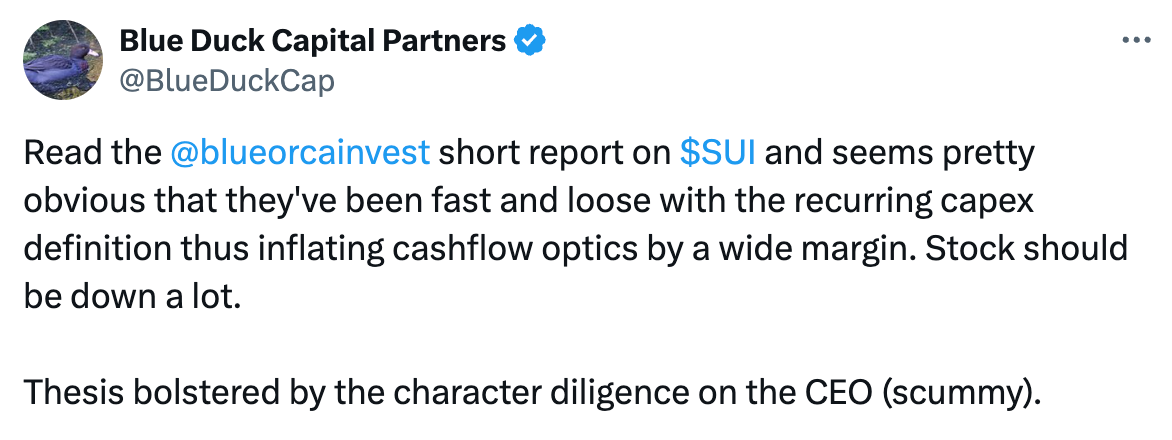

Blue Orca Capital published on Sun Communities (NYSE: SUI — $16.9 billion), a REIT focused on communities of manufactured homes. Blue Orca called the company “a mess of egregious executive behavior” and found that Sun’s CEO “received an undisclosed $4 million loan from the family of a supposedly independent Director who sits on the Audit Committee” and also separately “admitted borrowing $700K from a Director whose law firm also serves as [Sun’s] general counsel.” In addition, Blue Orca alleged the company inflates its “adjusted funds from operations” by claiming that its maintenance CapEx is actually growth-oriented “non-recurring” CapEx. Blue Orca concluded,

“Ultimately, we view [Sun Communities] as a highly levered governance failure tainted by scandal and a slew of undisclosed conflicts of interest, whose business is growing far slower and generates far less AFFO than investors are led to believe.”

Two Natural Cap, an anonymous substack, published on Tempus AI (NASDAQ: TEM — $8.31 billion), a health technology company. Two Natural Cap said Tempus “is primarily a cancer diagnostics business” and highlighted the company only earned ~1% of its 2023 revenue from AI offerings, none of which use generative AI. Two Natural concluded, “[Tempus] is not yet an AI company, and it doesn’t deserve to trade at an AI multiple.” Tempus is up ~35% since its June 2024 IPO.

Grizzly Research published on Qifu Technology (NASDAQ: QFIN — $4.59 billion), a Chinese credit technology company. Grizzly alleged the company has “outright fake financials, fraudulent backers, and an imploding business” and highlighted large disparities between the company’s SAIC filings in China and its SEC filings in the United States.

Hunterbrook Media published on Winnebago Industries (NYSE: WGO — $1.69 billion), an RV and motorboat manufacturer. Hunterbrook found that the company’s most popular RVs “appear to be experiencing widespread frame failure.” Hunterbrook found over “125 NHTSA complaints for 2020-2023 models [with] 91 mentioning frame issues” and also found Winnebago entered into non-disclosure agreements with owners of defective RVs that required owners to remove critical social media commentary of the company. Hunterbrook also claimed that many RV owners blame LCI Industries (NYSE: LCII — $3.06 billion), a popular RV frame manufacturer, for their RV issues.

Hunterbrook also separately published on AAR Corp (NYSE: AIR — $2.32 billion), an aircraft maintenance company. Hunterbrook claimed that its FOIA request for SEC visitor logs shows that the company’s Chief Ethics Officer, General Counsel, and a board member met with SEC officials in August amid inquiries “by the U.S. Department of Justice, SEC, [and] U.K. Serious Fraud Office, related to the company’s potentially illegal conduct in Nepal and South Africa.”

Gotham City Research published on Mutares (Frankfurt: MUX – 473 million euros), a German private markets investment holding company. Gotham City raised a number of accounting irregularities with the company including discrepancies in the company’s reported cash, excessive receivables from portfolio companies, and a rapidly growing debt burden.

Recent Resignations

Notable executive departures disclosed in the past week include:

CFO of Jamf Holding Corp (NASDAQ: JAMF — $2.23 billion) “entered into a transition and separation agreement” after a little over two years. The company’s CEO departed in September 2023 and the company is down ~55% since its July 2020 IPO.

CFO of Ammo Inc (NASDAQ: POWW — $171 million) “resigned upon request by the Board” after nearly six years. The company is audited by PKF Texas and also disclosed:

“A Special Committee of the Board of Directors has retained a law firm to conduct an independent investigation… determining whether the company and its management: (i) accurately disclosed all executive officers, members of management, and potential related party transactions; (ii) properly characterized certain fees paid for investor relations and legal services… The company’s outside auditors have indicated that they are not prepared to rely on representations from the company’s management team…”

In September 2022 The Bear Cave published on Ammo Inc and wrote: “a former NASCAR star and NRA executive currently sit on the board, an alleged pump-and-dump artist is listed as a key employee, a former board member raised concerns about whistleblower retaliation, and a current board member is running a proxy fight against his fellow board members.”

CEO of ACADIA Pharmaceuticals (NASDAQ: ACAD — $2.60 billion) was “involuntarily terminated without cause” after nine years and also departed the board. In January, the company’s General Counsel resigned “to pursue other opportunities” and in November 2023 the company’s Head of Research and Development departed after just eleven months “to pursue other opportunities.” In February, Culper Research called the company’s main drug “a total flop” and raised issues with how the company presented its efficacy data.

CEO of Masimo Corp (NASDAQ: MASI — $7.12 billion) “filed a claim in California state court relating to his employment agreement, as amended, seeking declaratory relief that he had validly terminated his employment for ‘Good Reason’” after 35 years as CEO.

Data for this section is provided by VerityData from VerityPlatform.com

Nine Month Review

The Bear Cave has published articles on twenty companies this year:

January 4 — Chegg (CHGG) has since fallen ~84%

January 18 — Klaviyo (KVYO) has risen 37%

February 1 — B. Riley (RILY) has fallen ~77%

February 1 — Applied Digital (APLD) has risen 60%

March 7 — Archer (ACHR) has fallen ~28%

March 21 — Hershey (HSY) has fallen ~2%

April 4 — Marqeta (MQ) has fallen ~17%

April 18 — Primerica (PRI) has risen 24%

May 1 — ExP World (EXPI) has risen 44%

May 16 — AMC Entertainment (AMC) has fallen ~18%

May 30 — RCI Hospitality (RICK) has fallen ~2%

June 6 — Globe Life (GL) has risen 25%

June 20 — DeFi Technologies (DEFTF) has risen 31%

July 18 — Teleperformance (TEP) has fallen ~6%

August 1 — TaskUs (TASK) has fallen ~27%

August 29 — Telus Digital (TIXT) is flat

August 29 — Concentrix (CNXC) has fallen ~31%

August 29 — TTEC Holdings (TTEC) has fallen ~20%

September 5 — Five9 (FIVN) has fallen ~4%

September 19 — Verint (VRNT) has fallen ~2%

On average, the companies profiled by The Bear Cave have declined 4.7% since publication compared to a 20.9% increase for the S&P 500 year to date. The Bear Cave is grateful for your support and will be releasing our most important investigation of this year on Thursday. Stay tuned!

What to Read

“SEC Charges Cassava Sciences, Two Former Executives for Misleading Claims About Alzheimer’s Clinical Trial” (SEC)

“The SEC’s complaint alleges that Cassava misled investors by announcing that the company’s therapeutic significantly improved patient cognition… however, Cassava failed to disclose that the full set of patient data – as opposed to the subset of data hand-selected by [the company] – showed no measurable cognitive improvement in the patients’ episodic memory.”

“SEC Charges DraftKings with Selectively Disclosing Nonpublic Information Via CEO’s Social Media Accounts” (SEC)

“The order finds that, on July 27, 2023, at 5:52 p.m., DraftKings’ public relations firm published a post on the personal X account of the DraftKings CEO. The post, according to the order, stated that the company continued to see ‘really strong growth’ in states where it was already operating… At the time of the posts, DraftKings had not yet disclosed its second quarter 2023 financial results.”

Tweets of the Week

Until Thursday,

The Bear Cave