The Bear Cave #77 + Five Earnings to Watch

New Activist Reports, Five Earnings To Watch, Recent Resignations, Tweets of the Week

Welcome to The Bear Cave — your weekly source of short-seller news. If you are new, you can join here. Please hit the heart button if you like today’s newsletter and reply with any feedback.

New Activist Reports

Citron Research published bullishly on DigitalOcean Holdings (NYSE: DOCN — $5.68 billion), an American cloud infrastructure provider. Citron highlighted that the company makes it simple and easy for small and medium sized business to get cloud computing. Citron wrote,

“After speaking with former employees, customers, and even the competition, we have found that DigitalOcean’s customer base is even more passionate and evangelical than that of Shopify, which leads us to believe that DigitalOcean will become the dominant SMB cloud provider.”

Bleeker Street Research published on Asensus Surgical (NYSE: ASXC — $578 million), a surgical robotics company with $3 million in annual sales and a history of consistent losses.

Spruce Point Capital Management published a strong sell opinion on Genius Sports Limited (NYSE: GENI — $3.51 billion), a sports data intermediary that works with sports leagues and bookmakers. The company went public via SPAC in April with an aggressive 12x revenue valuation and has near-term disintermediation risk according to Spruce Point.

Roddy Boyd at The Foundation for Financial Journalism published an update on Freedom Holdings (NASDAQ: FRHC — $3.94 billion), a retail brokerage with primary operations in Kazakhstan. Boyd highlighted that over half the company’s revenue comes from related-party transactions and that the company may be charging customers excessive fees. Boyd previously raised multiple potential issues with the company including a third-tier auditor, a U.S. headquarters in a co-working space, and an outside legal advisor with little public information.

Five Upcoming Earnings To Watch

Today post-market, CuriosityStream (NASDAQ: CURI — $578 million), an educational streaming platform that went public via SPAC, reports earnings. The Bear Cave previously highlighted that the company overstated its original content library. CuriosityStream trades at 13x revenue and may report slow growth because post-pandemic reopening may lead to less interest in online content.

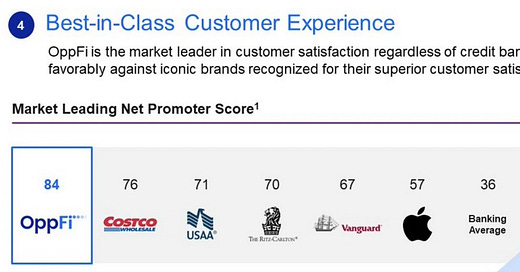

Today post-market, OppFi (NYSE: OPFI — $953 million) reports earnings. This is the company’s first earnings post-SPAC merger and management might address new regulatory issues facing the payday lender.

Wednesday, August 11 post-market, Payoneer (NASDAQ: PAYO — $3.38 billion) reports earnings. Payoneer is a high-risk payments provider that recently went public via SPAC and was previously profiled by The Bear Cave. Payoneer may see sales slow as post-pandemic reopening leads to less online spending.

Thursday, August 12 pre-market, Root Insurance (NASDAQ: ROOT — $1.91 billion) reports earnings. Root Insurance is a car insurance app that was criticized by The Bear Cave for making it difficult to cancel insurance policies and hiking insurance rates during the pandemic. Root Insurance may suffer as more drivers get back on the road and as poor customer service leads to higher churn.

Thursday, August 12 post-market, GreenBox POS (NASDAQ: GBOX — $445 million) reports earnings. The Bear Cave believes the company is more hype than substance and previously wrote,

“GreenBox POS describes itself as a blockchain-enabled next-generation payment processor. In reality, the company has questionable management, self-dealing, numerous lawsuits, and subcontracts work for the cannabis industry. GreenBox’s audit chairman was the CEO of a company that had its registration revoked by the SEC, and GreenBox’s co-founder and chairman filed for bankruptcy and paid a multi-million-dollar arbitration settlement amidst allegations of fraud. The company uplisted from OTC to the NASDAQ in February and its stock is up ~2,500% over the last year.”

Recent Resignations and Departures

Notable executive departures disclosed in the last week include:

CFO of CNA Financial (NYSE: CNA -- $12.0 billion) resigned after one and a half years “and is transitioning to a career in the technology sector.” CNA’s previous CFO lasted less than two years as well.

CEO of Romeo Power (NYSE: RMO -- $899 million) resigned after less than one year “to pursue new opportunities.”

CAO of Medifast (NYSE: MED -- $2.87 billion) resigned after one and a half years. The company has had six different CFOs over the last ten years.

Chief Revenue Officer of 8x8 (NYSE: EGHT -- $2.77 billion) resigned after about ten months. The company has had two different CEOs and three different CFOs in the last five years.

Data for this section is provided by InsiderScore.com

What to Read

“‘It has to be known what was done to us’: Natick couple harassed by eBay tell their story for the first time” (Boston Globe)

“It was June of 2019, and he had no clue that the vandalism was just the start of a bizarre harassment campaign directed by senior executives at one of the country’s leading Internet companies, eBay. Ultimately, the events would shatter the Steiners’ peaceful suburban life, result in criminal charges against six eBay employees and a contractor, five of whom have pleaded guilty, and contribute to the departure of eBay’s chief executive.”

“After Afterpay” (Net Interest)

“Unlike many fintech startups which create a lot of value for venture investors, these two have created most of their value in public. Square came to the market in November 2015 at a US$2.9 billion valuation and has created 98% of its value since; Afterpay came to the market six months later at a US$125 million valuation and has created 99.5% of its value since.”

Tweets of the Week

Until next week,

The Bear Cave